Source: Guosen Securities / Shuzheng Health

The sales of health food reached ¥14.07 billion from January to September of 2018, up 36.2% from the same period of last year. Both the sales volume and average price rose, by 23.1% and 10.6% respectively. Sales in September alone achieved ¥1.89 billion, a year-on-year increase of 29.7%, making a sustained growth from August.

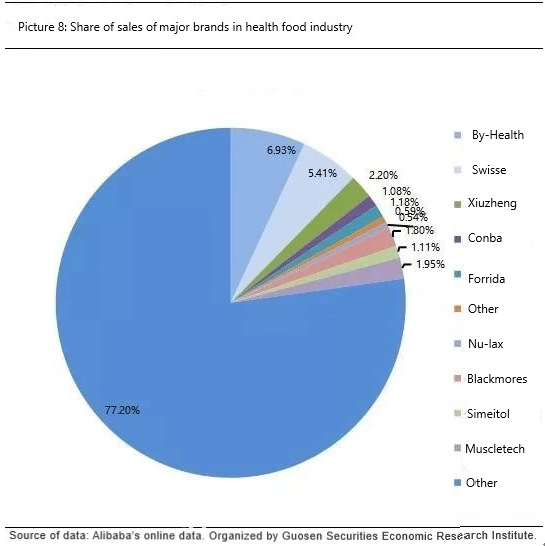

In terms of the brand and company, By-Health has continued to increase its sales volume and price. In September 2018, By-Health reached sales of ¥131 million (+44%), Swisse,¥102 million (+26%), and Muscletech,¥37 million (+10%).

Industry overview

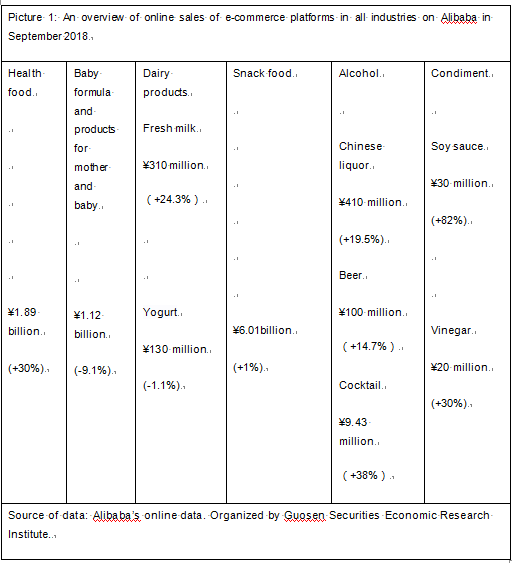

In September 2018, online sales figures were significantly affected by the consumption before National Day holiday. Industry sales recovered since last month, and the growth rate of health food, fresh milk, alcohol and condiments was prominent compared to the last year.

The average price of health food, milk powder, snack food, condiment, Chinese liquor and other industries has increased greatly, representing a sustained trend of consumption upgrade.

Health food, dairy products, condiments, beer and cocktails grew at a fast rate in the sales volume.

A glance at health food

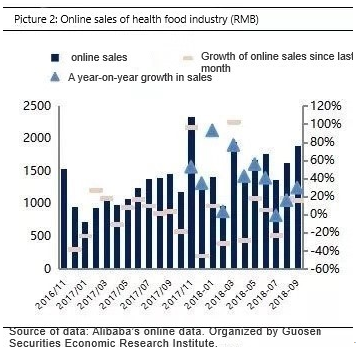

The growth rate of the industry has rebounded from the previous month, and the demand for high-end products has strengthened.

Health care products reached sales of ¥14.07 billion from January to September of 2018, up 36.2% year on year. Both the sales volume and average price increased, by 23.1% and 10.6% respectively, maintaining a fast overall growth rate.

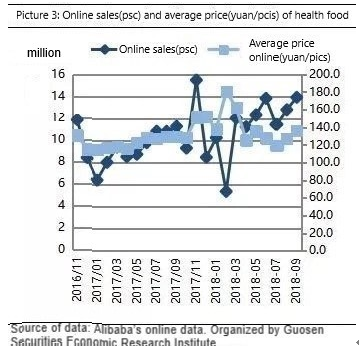

The sales in September alone reached ¥1.891 billion, an increase of 29.7% compared to last year, and a rise in the growth rate from August. Compared to the same period of last year, the sales volume was up by 23%, and the average price, 5.2%, showing a climbing sales trend.

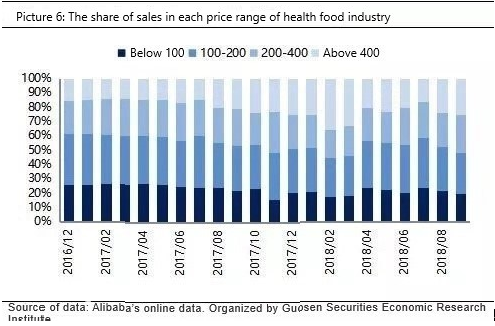

The share of per customer transaction with more than ¥400 increased from 22% in the same period of last year to 26%, and that of below ¥100 fell from 22% to 20%. The purchase trend of high-end products has emerged, with a rising consumer demand for quality health care products.

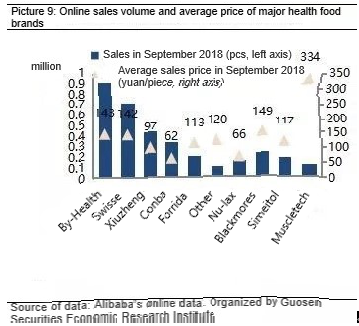

In terms of the brand and company, By-Health performed well with an increasing sales volume and average price. In September 2018, By-Health achieved sales of ¥131 million (+44%), Swisse, ¥102 million (+26%), and Muscletech, ¥37 million (+10%). By-Health rose from 6.2% in the same period of last year to 6.9% in the market share of the brand, and Swisse, falling from 5.6% to 5.4%.

In September, By-Health increased in sales volume by 26% year on year, a 2% growth rate since last month. Swisse went up in sales volume by 15% compared to last year, and its growth rate increased by 16% from last month. Muscletech’s sales volume rose by 14%, with a falling growth rate of 7% compared to last month. The unit price of By-Health is slightly higher than that of Swisse. The average price of By-Health rose by 14% in September, higher than that of Swisse, which was 10%. The average price of Muscletech’s whey protein category was significantly higher than the average, down 4% in September.

Sales: Sales achieves ¥1.891 billion in September 2018, an increase in growth rate.

In September 2018, the online sales of health food totaled ¥1.891 billion, an increase of 29.7% from a year earlier, showing an upward trend. The sales volume was up 23% and average price rising by 5.2% in September compared to the same period of last year.

Category analysis

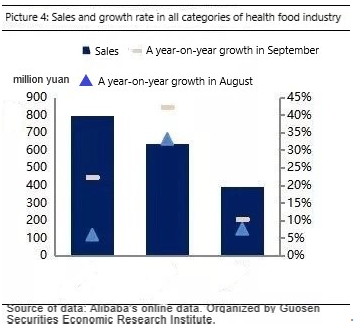

The sales of overseas dietary supplements, health food and ordinary nutritious food reached ¥794 million, ¥395 million and ¥636 million respectively, a huge growth in ordinary nutritious food in particular.

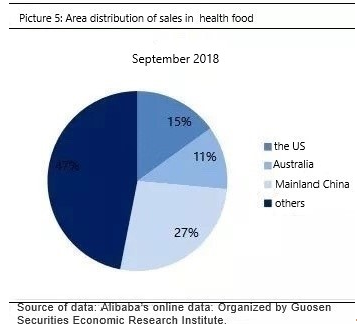

The whole category of health food has seen a sharp drop in sales. The overseas dietary supplements reached sales of ¥794 million in September 2018, accounting for 42%, a rise of 22% from a year earlier.

Domestic dietary supplements, a major sector of the health food, accounted for 21%, up 10% year on year.

Ordinary dietary supplements, which mainly include sports nutrition supplements and weight loss food, accounted for 34%, a year-on-year increase of 42%.

Price range

The share of health food below ¥200 has reduced, ¥200-400 maintaining stable, and that of above ¥400, increased.

From September 2017 to September 2018, the share of sales in each price range of health food changed as follows: health food below ¥100 fell from 22% to 20%, ¥100-200 falling from 30% to 29%. The share of heath food between ¥200-400 remained 26% and that of above ¥400, a rise from 22% to 26%.

The proportion of sales in medium-to low-end products below ¥200 has declined, ¥200-400 being stable, and that of medium-to high-end products above ¥400 has increased.

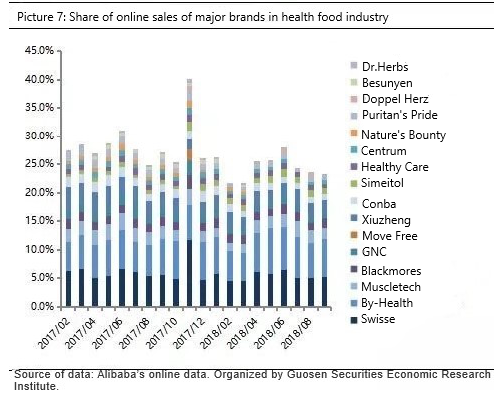

Brands market share

By-Health continues to maintain the leading role in health care products industry.

From September 2017 to September 2018, the market share of each brand changed as follows: By-Health rose from 6.2% to 6.9%, Swisse, falling from 5.6% to 5.4%, and Muscletech, a drop from 2.3% to 2.0%.

Monthly performance of brands

By-Health reached sales of ¥131 million in September 2018, followed by Swisse, ¥102 million.

The average price of whey protein products such as Muscletech is significantly higher than that of ordinary dietary supplements. The unit price of By-Health is slightly higher than that of Swisse.

The information above comes from Guosen Securities Economic Research Institute. Please indicate the source for quoting.

- White Paper on Bone and Joint Health of Chinese Consumers 2020

- Yili Dairy launched high-protein yogurt, focusing on sport people

- Sinopharm Xingsha launched the Japan's Champion probiotics

- China has introduced its first policy to support the industrial hemp industry

- Beyond Meat became the first overseas Artificial Meat company to set up a factory in China

- Nongfu Spring's market value exceeded HK $370 billion on its first day

- German infant nutrition brand Amykon launched two probiotics in China

- The revenue of Besunyoung in the first half year is about 610 million yuan

- Jellly candy and powder included in the health food filing dosage form in China

- H&H Group net profit increased by 9% for the first half of year